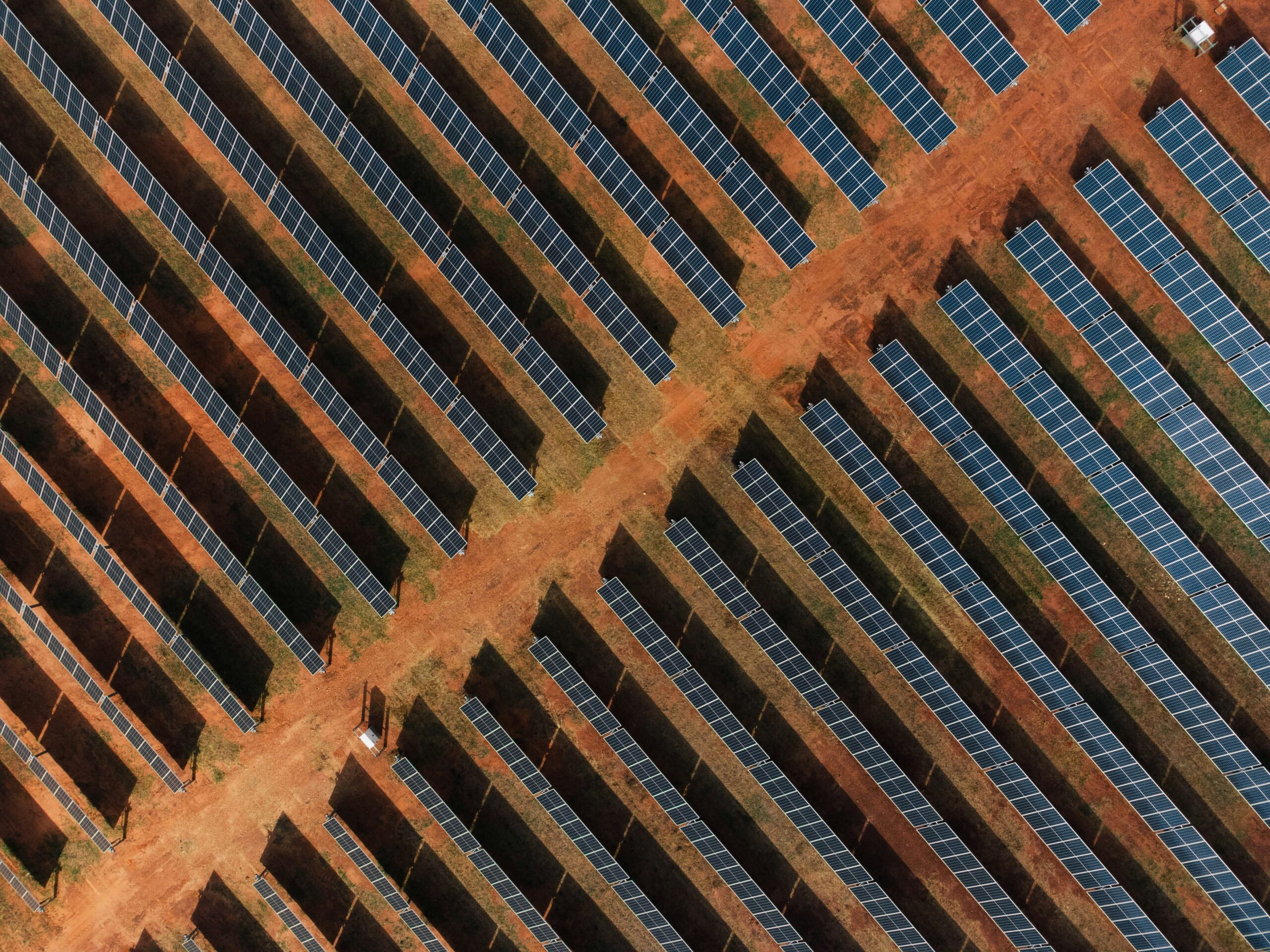

Belgium’s Wallonia region added 92 MW of solar in 2024

The rate of solar installations slowed in the Belgian region of Wallonia last year, as government incentives for residential solar came to an end. Brussels-based renewable energy federation Edora says deployment will need to accelerate across all market segments if the region is to meet its 2030 solar targets.

The rate of solar installations slowed in the Belgian region of Wallonia last year, as government incentives for residential solar came to an end. Brussels-based renewable energy federation Edora says deployment will need to accelerate across all market segments if the region is to meet its 2030 solar targets.

The Belgian region of Wallonia added only 92 MW of solar in 2024, according to figures made available by non-profit organization Energie Commune.

The result follows a record year for solar installations in the region in 2023. Marion Bouchat, photovoltaic advisor at renewable energy federation Edora, told pv magazine that while the residential segment, which accounted for almost three quarters of Wallonia’s solar capacity at the end of 2023, has performed the best historically, that is no longer the case.

“This segment is expected to have decreased by 80% to 90% compared to 2023, after the end of the net metering,” Bouchat said, adding that there are no longer any government incentives in place for residential installations less than 10 kW. While a support scheme for installations above 10 kW remains, Bouchat said that it is proving insufficient.

Bouchat added that large-scale solar is facing permitting issues, but also said there is “great potential to work in synergy with agricultural activity”, with only one project on agricultural land to date.

Wallonia has set a target of 5,100 GWh of energy annually through solar by 2030. A statement released by Edora to coincide with the publication of last year’s deployment figures says installations across all market segments will need to increase to meet this target.

Edora’s statement called for simplified permitting policies, a more incentive-based investment framework and strengthening of the electricity grid, as well as the acceleration of storage, coupled with dynamic pricing.

Bouchat told pv magazine Edora is also asking the government to create a development framework for ground-mounted solar in collaboration with the sector. “The PV ground projects are crucial to reach the regional targets,” Bouchat added. “The ambitious target of 5,100 GWh annually is achievable only with a committed policy and with the deployment of ground projects, as it will require an annual installed capacity over around 575 MW from now to 2030.”

Other regulatory changes that could support the Walloon market include a plan for solar installations on old and new buildings, Bouchat said, as well as the facilitation of energy communities, which currently do not have any financial incentives, such as a grid fee reduction.

Bouchat added that a flexibility market for the resolution of congestion issues, akin to the imbalance market at the national level, could act as a market driver in the future, but said it is currently “not on the table of our government.”

Edora is currently predicting around 200 MW of solar could be deployed in Wallonia in both 2025 and 2026 if constant policy support is in place, increasing to around 350 MW this year and to 520 MW in 2026 “if the government took more committed actions,” Bouchat added.

In February, pv magazine reported the Belgian region of Flanders added at least 646 MW of solar in 2024, as it celebrated its one millionth solar panel installation.

Energie Commune’s figures, from Belgium’s three electricity market regulators, show the country added 970 MW of solar across its regions in 2024, compared to over 2.4 GW in 2023. It attributes the decline to strong momentum in 2023 that was linked to incentives now removed in Flanders and Wallonia.

Last year’s result means Belgium’s cumulative solar capacity stands at around 12 GW, which is equivalent to 13% of the country’s electricity consumption last year. Each of Belgium’s three macro-regions has its own individual regulatory framework for solar and renewable energy.

What's Your Reaction?