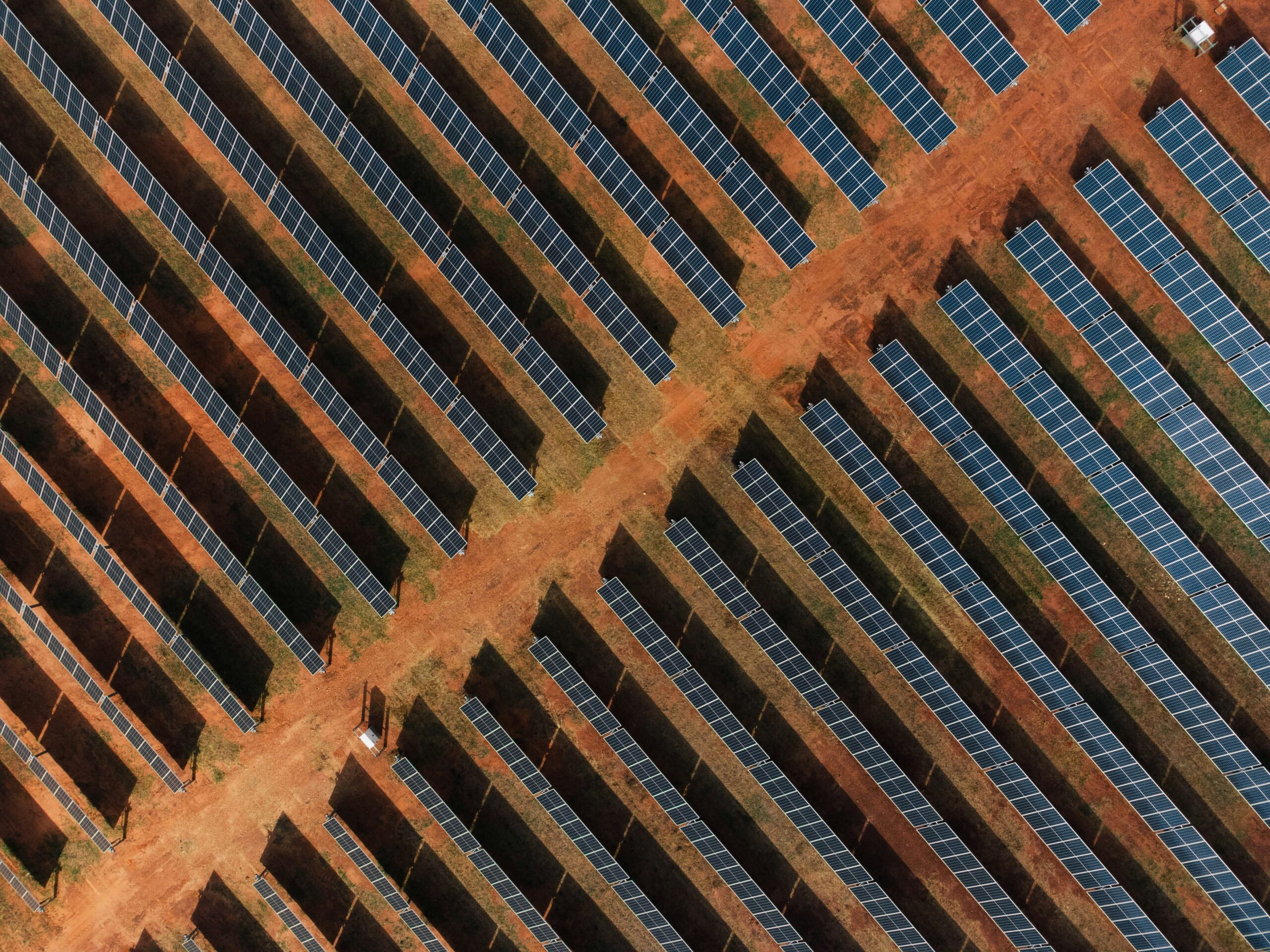

EU solar manufacturing needs private capital to build factories

The new Clean Industrial Deal provides a “specific boost” for European solar manufacturing, but a lack of financing and storage to support grids will continue to hold back deployment unless addressed.

The new Clean Industrial Deal provides a “specific boost” for European solar manufacturing, but a lack of financing and storage to support grids will continue to hold back deployment unless addressed.

SolarPower Europe’s CEO, Walburga Hemetsberger, welcomed Europe’s new Clean Industrial Deal’s (CID) strategy to prioritize domestic-made products in public procurement.

The CID was published on Feb. 26, as part of the EU’s strategy to accelerate decarbonization while also boosting industrial competitiveness.

“The intention to prefer EU-made products in public procurement should strengthen the Net-Zero Industry Act,” Hemetsberger pointed out, adding it would provide “a specific boost for European solar manufacturers.”

However, the move to prefer solar products made in the EU would work much better if it is bolstered by financing support for building and operating factories, she said. “We need to see EU products better rewarded in public procurement while staying clear of unnecessary barriers to solar deployment,” she said.

While the CID aims to provide more than €100 billion of EU funding to support domestic clean manufacturing, some commentators believe this needs to be complemented by private capital.

Diego Pavia, CEO at EIT InnoEnergy, said the deal was “a welcome boost to the clean technology sector and confirmation that cleantech is at the heart of Europe’s economic strategy.”

“However, this must be complemented by further mobilization of private capital to meet the volumes required to scale clean technology. Time is of the essence to develop new financing instruments,” he warned, adding “The EU cannot afford to wait for the next long-term budget cycle to finance these new initiatives. Final investment decisions (FID) by clean tech manufacturing ventures must be taken urgently in order to have an impact on 2030 climate targets.”

Pavia said the proposed expansion of the InvestEU financing program was a “welcome step to boost support for clean industrial scale-ups developing first-of-a-kind plants.”

Electrification for decarbonization

The wide-ranging set of policies encompassed by the CID includes affordable energy strategies and a plan to improve grid infrastructure. It also includes a new electrification target of 32% by 2030.

The CID “brilliantly sets electrification as a key pillar for industrial competitiveness and decarbonization,” Hemetsberger said. “We see that as a floor, not a ceiling. There are plenty of energy uses that are low-hanging fruit to electrify.”

She claimed the new Industrial Decarbonisation Bank “risks pitching electrification against gas-dependent solutions that look good on paper but miss the irrefutable benefits of electrification.

“Flexible, renewable-based, electrification can reduce day-ahead energy prices by 25% by 2030. Investment in electrification must be prioritized over short-term fossil-based solutions,” she warned.

While the CID contains an Affordable Energy Action Plan to make energy less expensive for citizens, its expected benefits might not materialize if the bloc continues to finance liquid natural gas (LNG) infrastructure. According to Hemetsberger, investing in LNG will not reduce fossil fuel price volatility.

Grids and storage

Old and overwhelmed grids remain a big problem for the European Union, and the CID’s Grids Package aims to modernize the bloc’s network. However, without the inclusion of storage, the plan may not go far enough.

“Getting the upcoming Grids Package right is critical to the success of the competitiveness agenda,” said Hemetsberger. “It should be a Grids and Storage Package. Battery storage is the absolute shortcut to lower, less volatile energy prices. Where is Europe's battery storage strategy?”

What's Your Reaction?