Venture capital sees opportunities in digitalization, software-driven PV models

Vireo Ventues Managing Partner Felix Krause speaks with pv magazine about solar-related investments in the startup landscape.

Vireo Ventues Managing Partner Felix Krause speaks with pv magazine about solar-related investments in the startup landscape.

The Vireo Electrification Fund, which Vireo Ventures launched at the end of 2022, is an early-stage venture capital fund with a dozen energy technology startups in its portfolio. Vireo Ventures Managing Partner Felix Krause recently sat down with pv magazine to talk about solar energy opportunities and startups.

“Starting a new business often requires substantial financial backing to transform ideas into reality, and this is where venture capital plays a pivotal role,” he said. “Venture capital is a form of private equity investment specifically designed for early-stage, high-growth startups in need of capital to scale. It provides funding across various stages, each tailored to meet the evolving needs of the company, with distinct goals and investor profiles at each phase.”

According to Krause, early-stage venture capital funding typically spans pre-seed, seed, and Series A rounds, providing the necessary capital to refine products, validate market fit, and scale operations. At the pre-seed and seed stages, VCs support early product development, initial market research, and team building.

“VC investors target companies with strong growth potential, offering not just capital, but strategic support to help accelerate success,” he added. “As the company progresses, Series A funding enables the optimization of business models and expansion efforts. In return for capital, VCs acquire equity stakes and may take an active role in guiding the company's strategic direction, helping to accelerate growth in competitive sectors like digital energy technology.”

When it comes to solar and adjacent industries, the company invests in digitalization and software-enabled business models that have recurring revenues. The target company might also offer a small hardware device, or a box, but its main product is software.

One example is Green Fusion, whose technology enables control, monitoring, analysis and optimization of hybrid and conventional heating systems. Another example is Amperecloud, which provides data monitoring and integration into monitoring, management, and maintenance applications for both solar and battery energy storage systems.

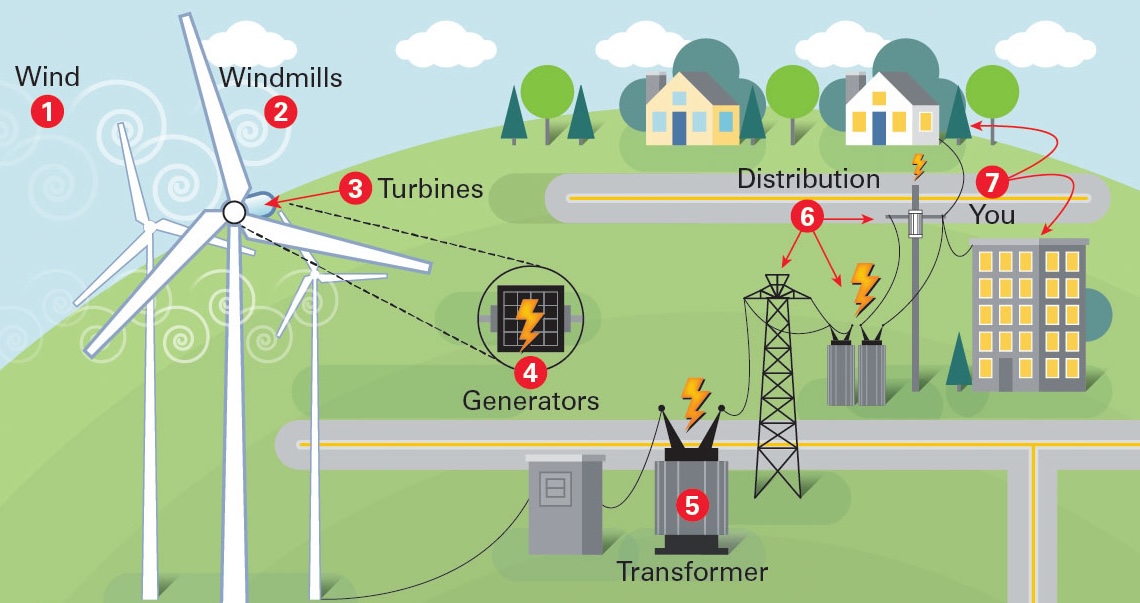

Vireo Ventures also targets startups developing technology to electrify and connect heating, cooling, mobility, and industry sectors, also known as sector coupling. Energy management solutions shift the timing of electricity consumption or modify heating temperatures to better coincide with cheap rates.

“Bidirectional electric vehicle charging is another area that could give startups an opportunity to offer technology to balance the grid, reducing end users’ costs, but also reducing the need to build out additional grid infrastructure,” Krause said. “Agrivoltaics overcomes issues that some parts of society have with seeing solar PV or wind turbines in their community. It maximizes renewable energy output while minimizing land use conflicts. It is relevant in countries like Germany and France where there have been problems with new solar site acceptance.”

Other solar-related opportunities may be offered by the emergence of financial mechanisms such as contracts for difference (CfDs), supported by European governments, which could catalyze investment in solar as the business case is improved with integrated with battery energy storage systems, which could generate stable revenue.

“There is a benefit for the owners of solar farms to avoid curtailment losses, and for the grid operator as it ultimately addresses some of the issues of renewable-related grid stability,” explained Krause.

He said more women are joining founding teams, with five of the 12 portfolio companies having a female founder or a woman in the founding management team.

“Skilled founders coming with software startup skills that a few years ago might have founded a fintech company are starting up ventures in climate and energy industries,” he said. “They are attracted by wanting to have a positive impact, no doubt, but also because they see the opportunity to build good businesses.”

The strong regulatory environment and strength of incumbents sometimes presents a very difficult environment for startups to navigate. The incumbents have access and an understanding of regulatory environments, and they already have a huge customer base.

“Therefore, we believe that there won't be a dramatic disruption by a startup offering better processes and pushing out a large company like RWE in the near future,” stated Krause. “Nevertheless, startups are more agile, innovative, and cost-efficient. As a result, we want to encourage the collaboration and incorporation between incumbent and start-ups, so that both can concentrate on what they can do best in a market that offers huge growth potential.”

What's Your Reaction?