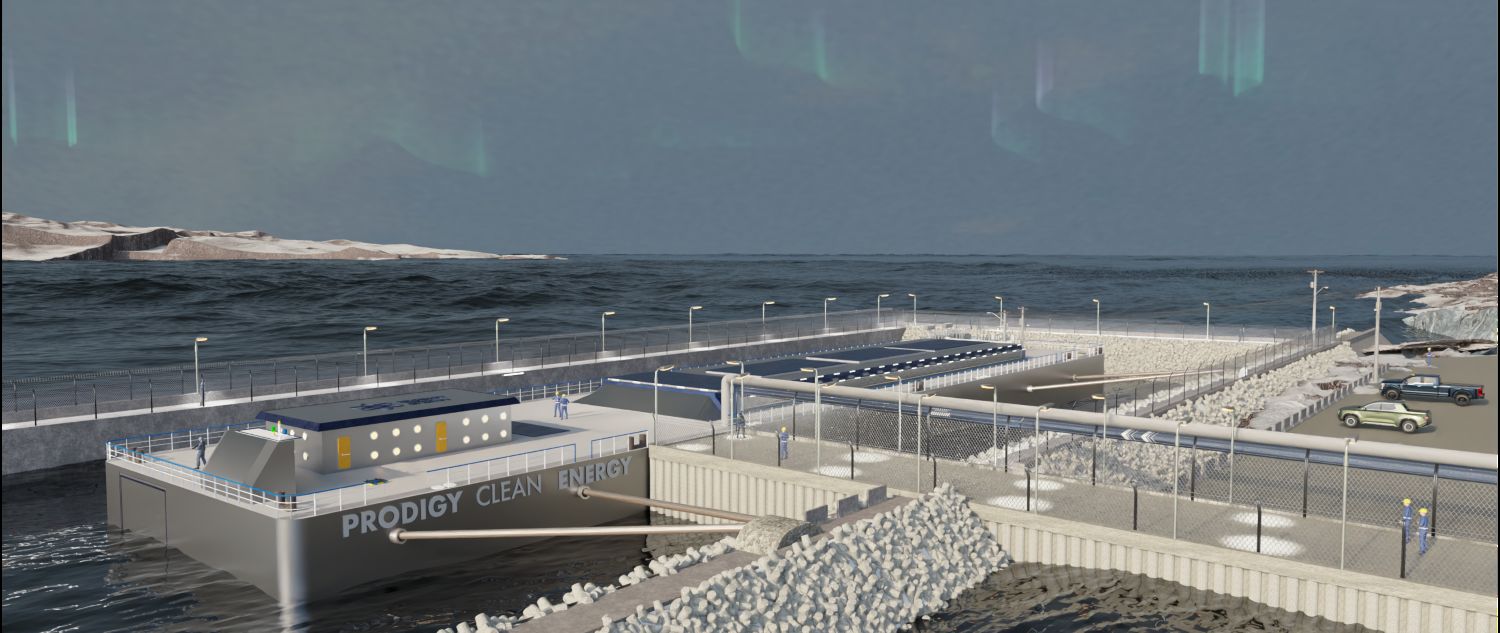

bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture

bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture Murray Auchincloss, chief executive officer, bp, said: This is a […] The post bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture appeared first on Hydrogen Central.

bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture

- Strategy fundamentally reset: reducing and reallocating capital expenditure, significantly reducing costs and driving improved performance – to grow cash flow and returns – supporting a stronger balance sheet and resilient distributions.

- Growing upstream: increasing oil & gas investment to ~$10bn p.a.; strengthening portfolio; growing production to 2.3–2.5mmboed in 2030; additional ~$2bn operating cash flow in 2027.

- Focusing downstream: reshaping portfolio to drive growth; high-grading and focusing on advantaged and integrated positions; announced strategic review of Castrol; driving improved performance; additional $3.5–4bn operating cash flow in 2027.

- Disciplined investment in the transition: selective investment in biogas, biofuels and EV charging; capital-light partnerships in renewables; focused investment in hydrogen/CCS; investment in transition businesses of $1.5–2bn p.a., over $5bn p.a. lower than previous guidance.

- Updated financial frame: reducing annual capex to $13–15bn to 2027; targeting significantly higher structural cost reductions of $4–5bn by end 2027; $20bn divestments by 2027, including potential proceeds from Lightsource bp and strategic review of Castrol; reducing net debt, targeting $14–18bn by end 2027; resilient shareholder distributions, guidance of 30–40% of operating cash flow.

- Growing free cash flow and returns: targeting >20% compound annual growth in adjusted free cash flow to 2027, and returns on average capital employed of >16% by 2027.

Murray Auchincloss, chief executive officer, bp, said:

This is a reset bp, with an unwavering focus on growing long-term shareholder value.

This strategy will see bp grow its upstream oil and gas business, focus its downstream business, and invest with increasing discipline into the transition. It builds on bp’s distinct strengths and competitive advantages as an integrated energy company – with a world-class portfolio with top tier oil and gas businesses in attractive basins and leading integrated positions and brands across value chains, all underpinned by trading, technology, and partnerships.

Chief executive Murray Auchincloss said:

Today we have fundamentally reset bp’s strategy.

“We are reducing and reallocating capital expenditure to our highest-returning businesses to drive growth, and relentlessly pursuing performance improvements and cost efficiency. This is all in service of sustainably growing cash flow and returns.

Murray Auchincloss, chief executive officer, bp, said:

We will grow upstream investment and production to allow us to produce high margin energy for years to come

“We will grow upstream investment and production to allow us to produce high margin energy for years to come. We will focus our downstream on markets where we have leading integrated positions. And we will be very selective in our investment in the transition, including through innovative capital-light platforms. This is a reset bp, with an unwavering focus on growing long-term shareholder value.”

Helge Lund, bp’s chair, added:

The board believes that this is an important strategic reset for bp and is confident that it, together with rigorous performance management, will deliver improved performance and sustainable value for bp’s shareholders.

“Over the past 12 months, we have worked closely with Murray and his team as they have developed the new direction, ensuring it reflects the significant changes we have seen in energy markets and our purpose of delivering energy to the world today and tomorrow. This new direction places free cash flow growth, returns and value at its heart.”

READ the latest news shaping the hydrogen market at Hydrogen Central

bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture, source

The post bp today introduced a fundamentally reset strategy, with significant capital reallocation – limited further projects in hydrogen and carbon capture appeared first on Hydrogen Central.

What's Your Reaction?