Pexapark records 22 European PPAs for over 1.4 GW in April

Pexapark says the number and volume of power purchase agreements (PPA) signed in April fell largely in line with the month prior, but for the first time in many years, utility PPAs outperformed corporate agreements.

Pexapark says the number and volume of power purchase agreements (PPA) signed in April fell largely in line with the month prior, but for the first time in many years, utility PPAs outperformed corporate agreements.

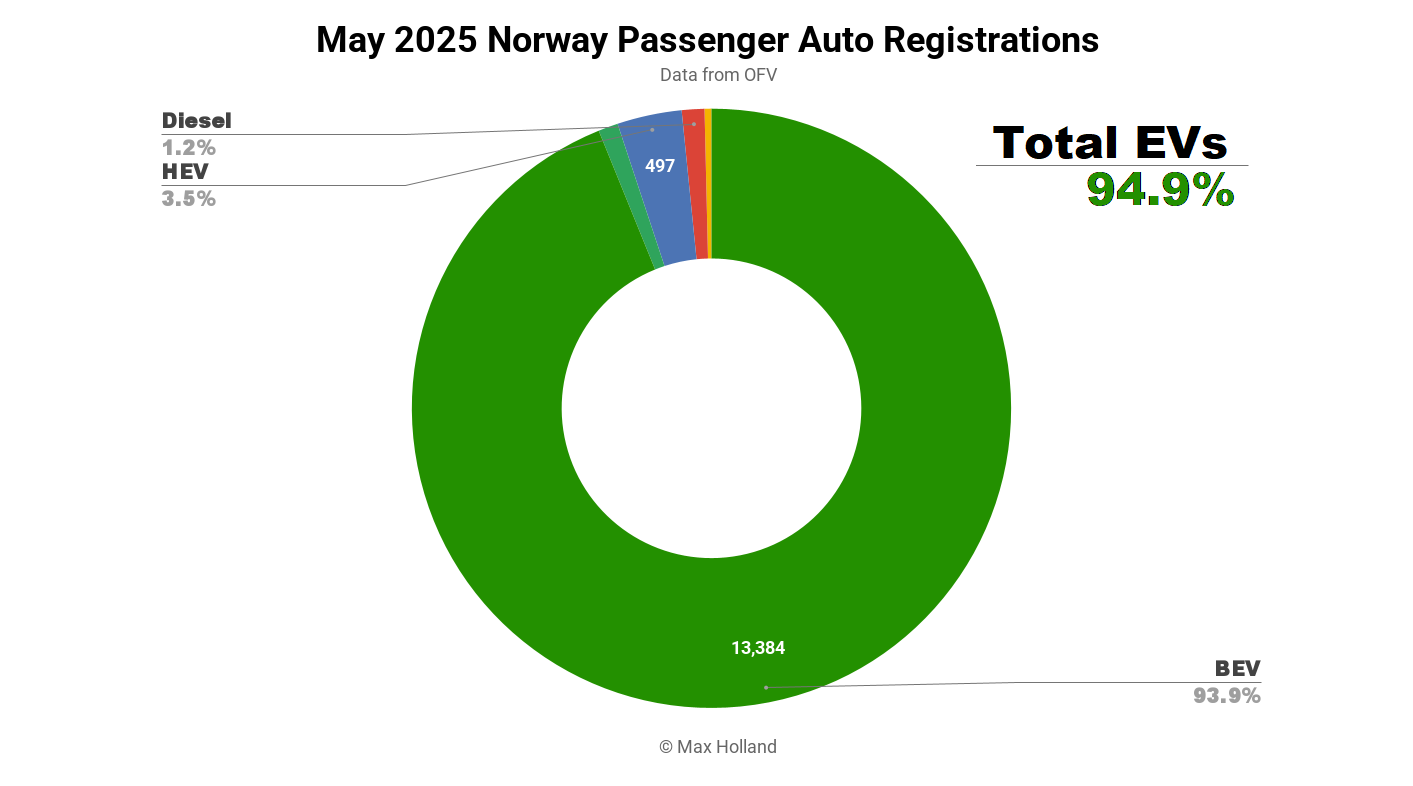

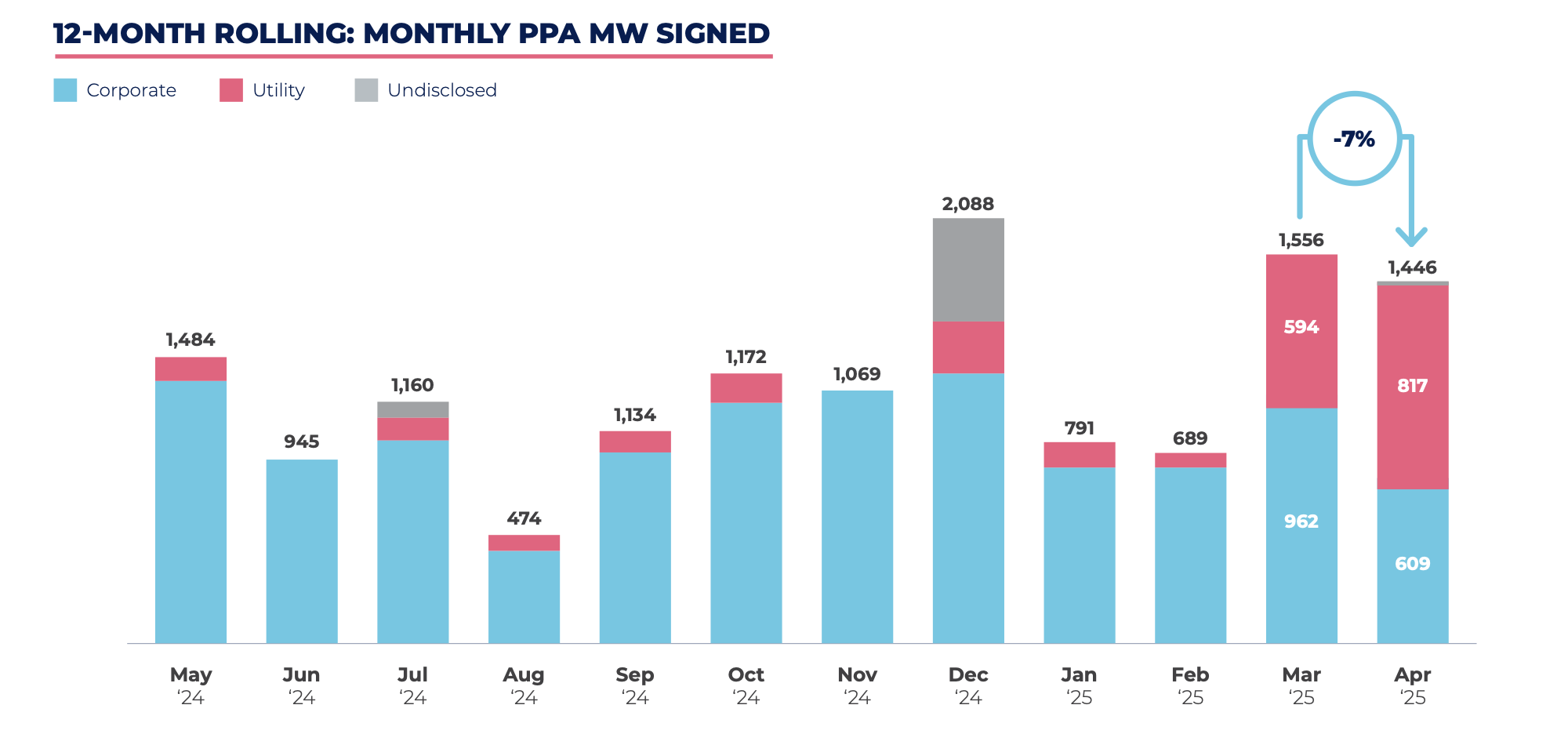

European developers signed 22 PPAs totalling 1,446 MW in April, according to the latest report from Swiss renewables research firm Pexapark.

Pexapark said April managed to continue “the momentum of relatively high volumes,” falling only slightly behind results from March.

Utility PPA volumes surpassed corporate PPAs for the first time in many years, Pexapark’s analysis adds, accounting for 57% (817 MW) of total disclosed volumes across eight deals.

Solar accounted for over half of the capacity signed last month, totaling 759 MW across 10 deals.

The majority of this solar capacity is covered in the largest deal of the month, which was an intra-group PPA in Greece where Meton Energy, a joint venture between RWE and PPC Renewables, signed a 10-year PPA with PPC and RWE Supply and Trading for the output of a 567 MW solar portfolio. The second and third largest deals of the month were both wind PPAs.

Pexapark noted that tracked PPA prices fell 1.6% month on month, settling at €48.80 ($55.32)/MWh. For the second consecutive month, Poland registered the steepest drop, with PPA reference prices falling 6.8%. PPA prices were also down in the British, Dutch, French, German, Italian and Portuguese markets.

The Nordic and Spanish markets bucked the trend, with PPA prices increasing by 7.5% and 2.5% respectively. In the case of the Nordics, Pexapark says the surge followed fluctuations in future power prices, primarily influenced by shifts in the hydrological balance.

What's Your Reaction?