Solar growth drives cross-border cannibalization in Europe, says Enervis

Retail electricity prices in Europe are falling but remain above pre-war levels, according to energy market analyst Enervis. PV capture rates are also dropping sharply, with negative pricing hours expected to persist in the short term.

Retail electricity prices in Europe are falling but remain above pre-war levels, according to energy market analyst Enervis. PV capture rates are also dropping sharply, with negative pricing hours expected to persist in the short term.

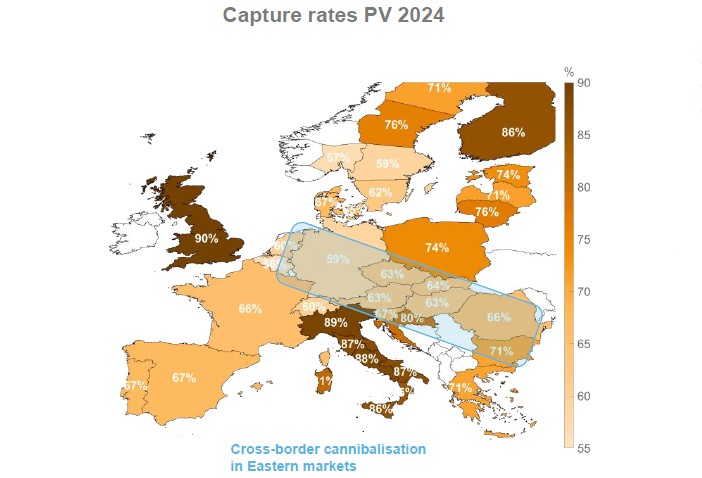

Enervis highlighted a sustained, sharp decline in capture rates for PV electricity across nearly all markets. Germany saw the steepest drop, with a 2024 capture rate of just 59%, the lowest in Europe. The highest capture rates were in the United Kingdom (90%), Italy (86% to 89%), and Finland (86%).

Cross-border cannibalization intensified in Southeastern Europe. The trend, originating in Germany, caused PV capture rates to fall significantly in Austria, the Czech Republic, Slovakia, Hungary, and Romania, reaching just 63% to 66%.

“In times of high photovoltaic generation, large amounts of electricity are exported from countries with a high share of photovoltaics to countries with a low share of photovoltaics,” said the report. “This additional electricity supply reduces domestic capture rates in countries with a low share of photovoltaics faster than the historical trend in the pioneering markets.”

Despite still-elevated baseload prices in 2024, PV cannibalization further cut market revenues. Enervis recorded a capture price of €47 ($48.83)/MWh for PV in Germany, higher than in the Nordic countries, France, Spain, or Portugal.

Negative wholesale electricity price hours surged across Europe in 2024, primarily affecting PV generation. Spain recorded its first-ever negative price hours, while the Netherlands and Germany saw the highest occurrences. As a result, PPA buyers are increasingly seeking to share risk, putting pressure on producer prices.

Enervis found that nearly 20% of PV generation in Germany in 2024 was affected by negative price hours. Additional storage and grid flexibility could mitigate the impact, but their expansion lags behind PV and wind deployment. Enervis' base scenario projects 390 GW of new renewables between 2025 and 2030 but only 93 GW of added storage.

“During this period, price volatility is expected to remain at a high or higher absolute price level, and there is also an increasing frequency of zero or negative price hours and scarcity prices,” the study stated. “Systems that can add flexibility to the system will be of high economic value, especially in this medium-term transition phase.”

What's Your Reaction?