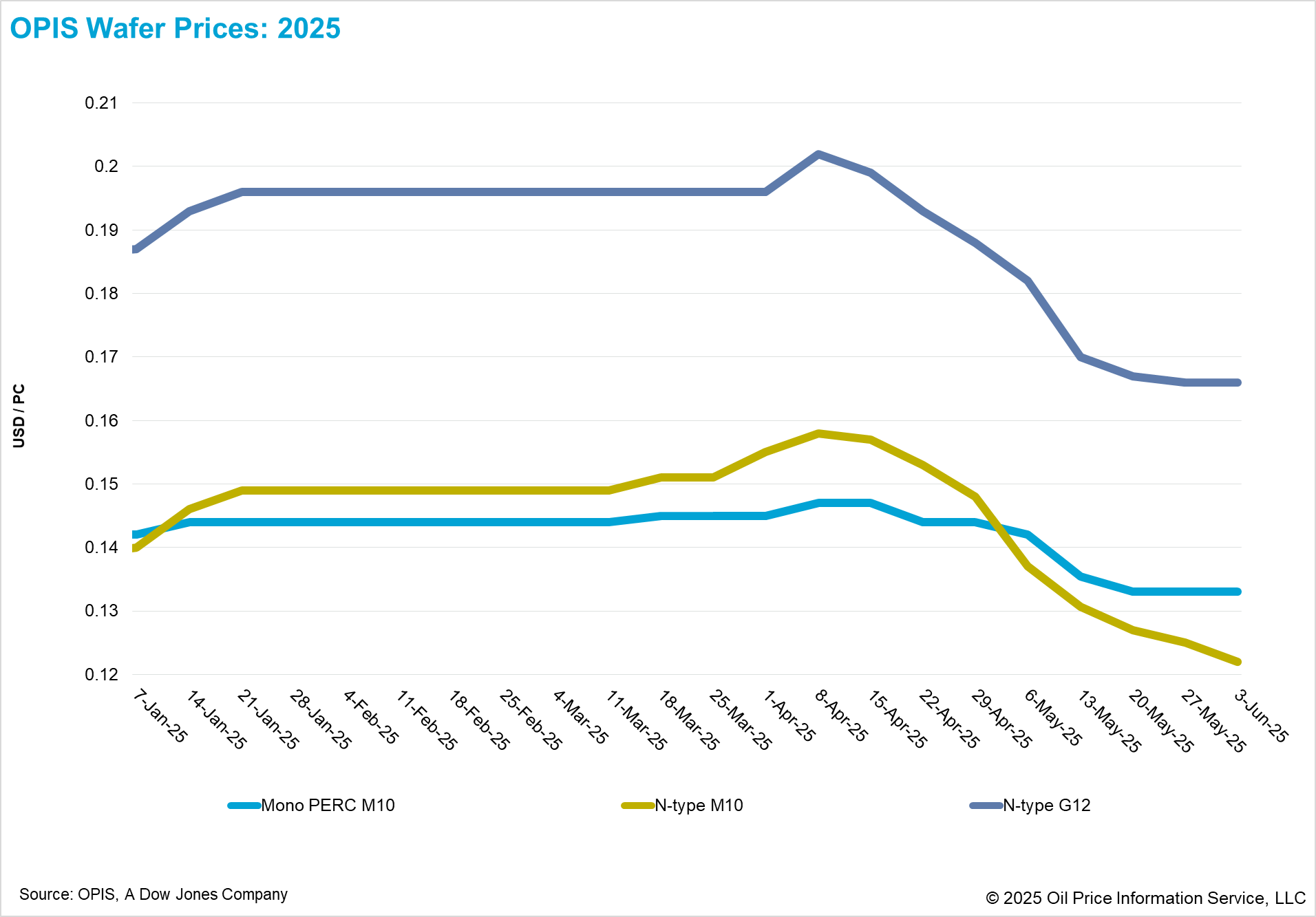

Solar wafer prices decline 22.78% since April peak

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

This week, FOB China prices for Mono PERC M10 and n-type G12 wafers held steady at $0.133/pc and $0.166/pc, respectively. In contrast, n-type M10 wafer prices declined to $0.122/pc, marking a 2.40% week-on-week drop.

The downward trend in n-type M10 wafer prices has now extended to eight consecutive weeks, driven by persistently weak downstream demand. Since their peak in early April, prices have declined by 22.78%. Market sources report that certain n-type 182 mm x 183.75 mm wafers in the Chinese domestic market are already trading below CNY 0.95 ($0.13)/pc.

In response to falling prices, some wafer manufacturers, particularly second and third-tier players with less focus on product efficiency, have incorporated a higher proportion of lower-grade polysilicon feedstock to lower production costs. These firms have reportedly brought their cash production cost for n-type M10 wafers down to around CNY0.90/pc. However, they remain unprofitable when factoring in labor, management, and sales expenses.

The financial strain across the sector is becoming more visible. Ahead of next week’s 18th (2025) SNEC exhibition in Shanghai, some manufacturers have reportedly withdrawn previously reserved booth spaces. Industry insiders interpret these cancellations as last-resort cost-saving measures, highlighting the acute financial stress many companies are facing.

On the supply side, sources noted that wafer inventories have eased from their mid-May peak of over 20 GW. Falling wafer prices have reached more acceptable levels for downstream buyers, leading to a modest pickup in procurement. Sources estimate China's solar cell production in May at around 56 GW, while wafer production is projected at up to 50 GW, suggesting a narrowing gap and contributing to recent inventory drawdowns.

Under typical supply-demand dynamics in the solar market, upstream production planning tends to exceed that of adjacent downstream segment by approximately 5% to account for processing losses and ensure continuity across the value chain, one source added, noting that the current reversal, with wafer output lagging, underscores ongoing overcapacity in the market.

Operationally, according to market feedback, the two largest wafer producers are running at around 50% utilization, while integrated manufacturers average about 55%. Some specialized wafer firms have reportedly reached up to 80% utilization. With wafer prices at new lows, certain integrated players are reducing self-produced wafer volumes and turning to the spot market for cheaper external supply. Some are also outsourcing wafer slicing to third-party manufacturers equipped with more advanced technologies. The wafer slicing service fee in China currently stands at approximately CNY 0.20/pc, trade sources noted.

In the global market, Vietnam continues to lead wafer production across Southeast Asia, according to industry sources. Feedback on regional operating rates indicates that Vietnam’s monthly wafer output remains at approximately 600 MW, with an estimated polysilicon consumption of around 1,300 MT per month.

On the export front, n-type 182 mm x 182 mm and 182.2 mm x 182.2 mm wafers continue to represent the primary export sizes from China, while demand for 182 mm x 183.75 mm and 182.2 mm × 183.75 mm wafers is growing. Although the production costs of these sub-sizes are reportedly broadly similar, variations in customer requirements are creating supply-demand mismatches for each format, driving price volatility. Export prices for n-type 182 mm x 182 mm wafers can occasionally reach as high as $0.140–$0.145/pc due to customized production and format-specific demand, a trade source noted.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

What's Your Reaction?