China moves to curb solar overcapacity, stabilize pricing

China’s top industry officials have vowed to curb low-price competition and excess capacity in the solar sector, as authorities begin implementing measures aimed at stabilizing supply chains and rebalancing the market.

China’s top industry officials have vowed to curb low-price competition and excess capacity in the solar sector, as authorities begin implementing measures aimed at stabilizing supply chains and rebalancing the market.

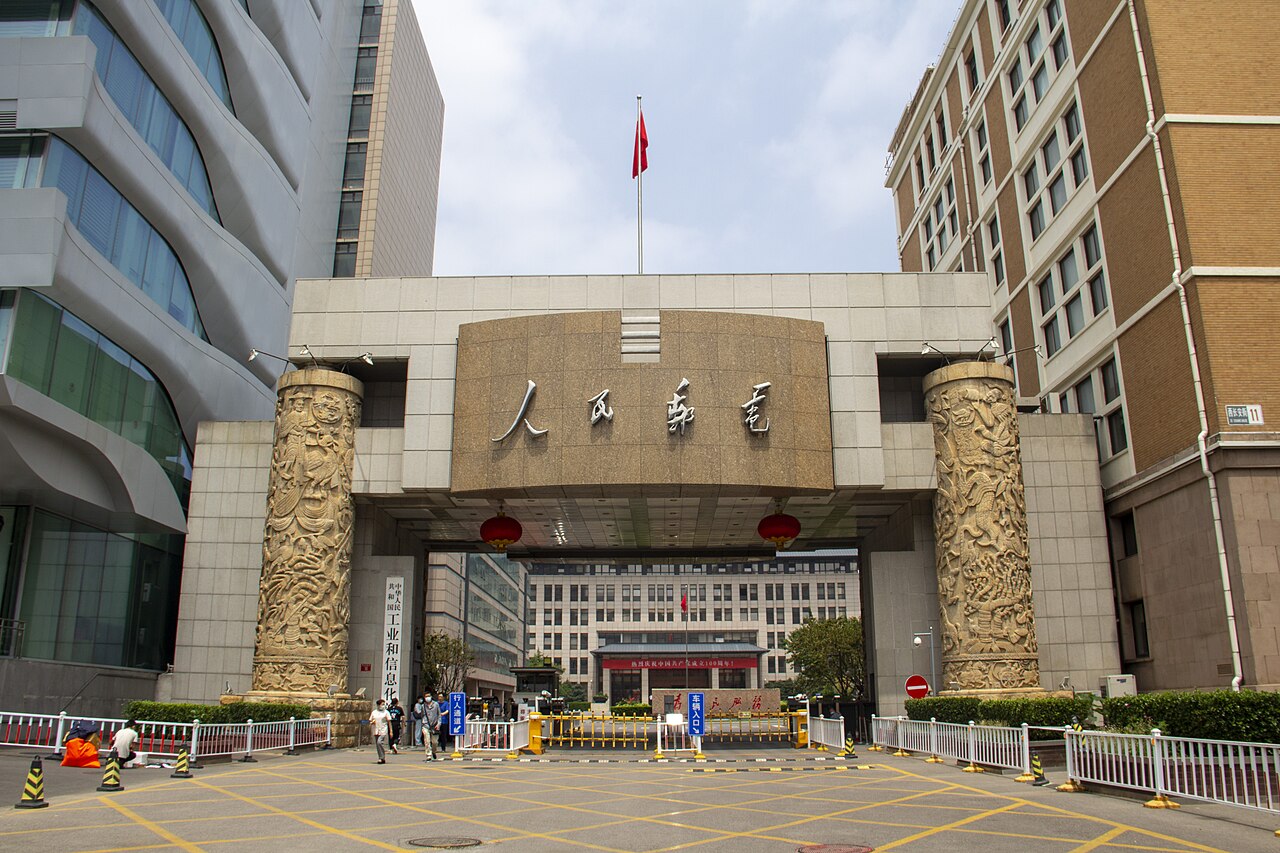

China’s Ministry of Industry and Information Technology (MIIT) held a high-level meeting with solar industry leaders last week, signaling the government’s plans to carry out directives from the Central Financial and Economic Affairs Commission. The authorities aim to curb “disorderly” competition and guide the sector toward more sustainable growth.

MIIT Minister Li Lecheng chaired the meeting, which included 14 major solar companies such as Longi, Tongwei, GCL, Trina, JA Solar, and Sungrow, as well as the China Photovoltaic Industry Association (CPIA). The session followed the Central Committee’s sixth economic policy meeting on July 1, where senior officials called for action on “irrational” pricing, the removal of outdated capacity, and improvements in industrial quality.

According to the official MIIT statement, the solar industry must “firmly implement the central government’s decisions, resolutely crack down on low-price disorderly competition, and promote the orderly exit of outdated capacity.” Li noted the need for industry self-discipline and urged companies to focus on innovation, product quality, and long-term competitiveness.

The meeting took place amid broader national discussions about “rat race,” a term in China used to describe highly competitive and inefficient environments, also referred to as “involution.”

In the lead-up to the MIIT meeting, the state-run People’s Daily published a front-page commentary criticizing destructive price wars and calling for structural reforms to restore market order.

Some parts of the supply chain have already started adjusting. In the glass segment, 10 manufacturers –including Xinyi Solar and Flat Glass – announced plans to cut production by 30% in July to reduce oversupply.

In the polysilicon segment, consolidation appears to be underway. GCL Technology’s co-CEO said at a recent trade fair that large producers are exploring mergers and acquisitions to absorb smaller competitors. Daqo New Energy echoed that view in a July 1 statement, expressing openness to collaborative solutions.

Figures from the China Nonferrous Metals Industry Association show that polysilicon prices have remained below cost for more than a year, with at least four producers suspending operations in the first half of 2025.

Investors responded quickly to the policy signals. Solar stocks surged in mainland China and Hong Kong following the MIIT meeting. Shares in nine Chinese solar companies, including Tongwei, Flat Glass, and Eging PV, hit their daily trading limits on July 3. Daqo Energy gained more than 15%, and GCL’s Hong Kong-listed shares rose 9%.

Still, analysts remain cautious about the pace and scale of restructuring. While central policymakers have drawn a clear line, overcapacity remains entrenched across China’s solar value chain. Restructuring in silicon, wafer, and module manufacturing could take months or years to take effect.

The government’s stance is clear: China’s solar sector, once a symbol of industrial policy success, now faces pressure to shift from rapid expansion to quality-focused consolidation.

What's Your Reaction?