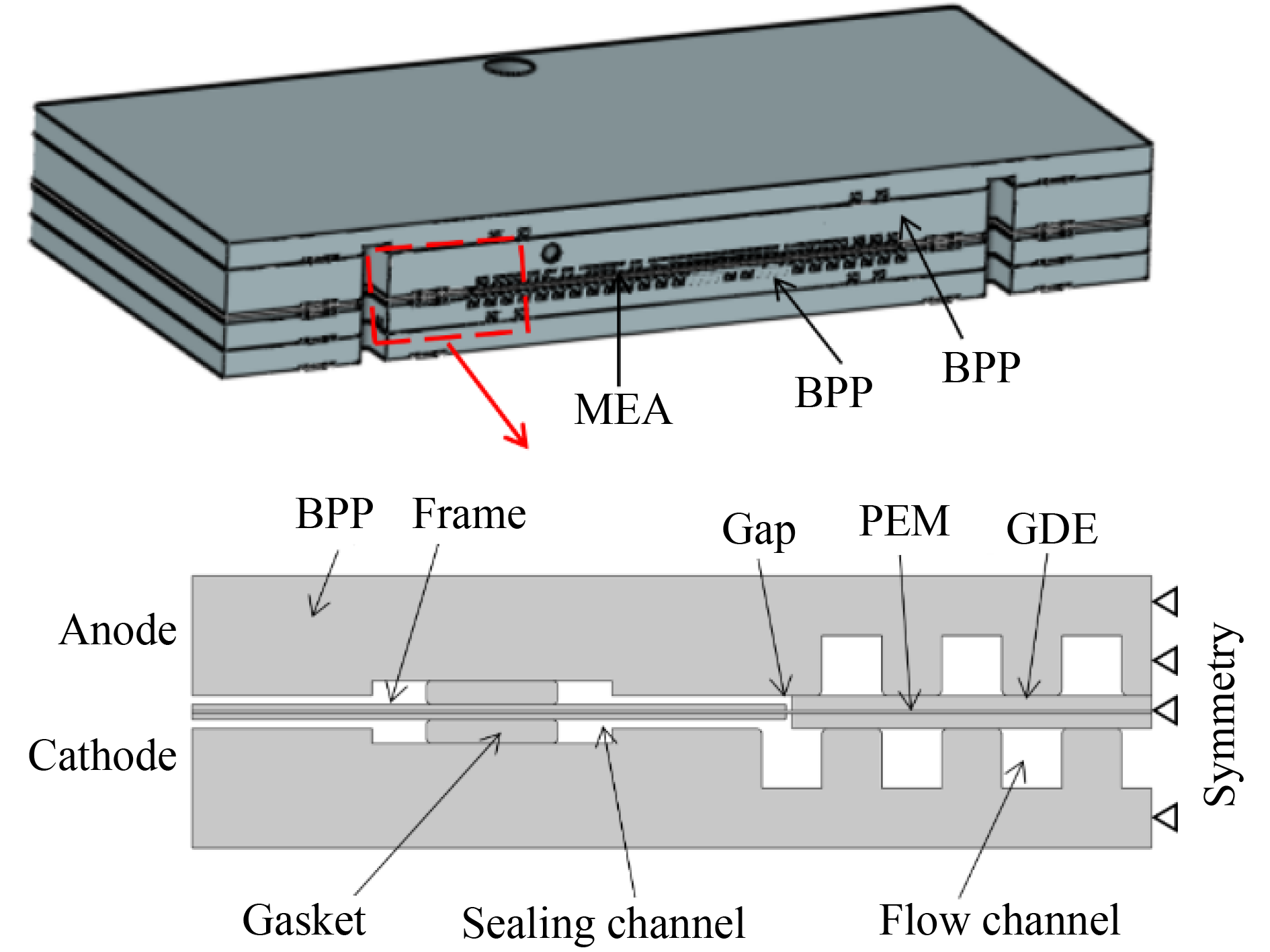

Dexter Energy adds battery support to forecasting, PV power optimization platform

The Dutch company says its short-term trading solutions for solar and other renewable energy technologies, supports grid balancing, reduces the costs of imbalance, and optimizes energy flows in an “increasingly volatile” energy market. It is growing internationally, and expanding its support of battery-related trading.

The Dutch company says its short-term trading solutions for solar and other renewable energy technologies, supports grid balancing, reduces the costs of imbalance, and optimizes energy flows in an “increasingly volatile” energy market. It is growing internationally, and expanding its support of battery-related trading.

Dexter Energy, a Netherlands-based developer of solutions for short-term power trading and optimization of solar, wind, and storage assets, is expanding with plans to enter new geographic markets and boost its software platform with battery asset-related trading and by optimizing existing products.

The Amsterdam-based company offers advanced machine learning and optimization software used by utilities, offtakers, and independent power producers (IPPs) to support forecasting and short-term power trading.

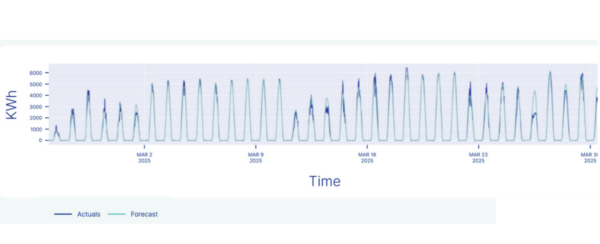

The platform uses predictive artificial intelligence (AI), a mix of advanced machine-learning techniques, such as gradient-boosted decision trees, deep neural networks, and probabilistic time-series models, to forecast power output, short-term power prices, and grid imbalances, according to Luuk Veeken, Dexter Energy CEO.

It claims a “high-accuracy” forecasting system. “We know that our power forecast is highly accurate because our customers consistently confirm this. To convince new customers to use our Power Forecast, we need to compete head-to-head in trials with other forecasters each time,” Veeken told pv magazine. “The fact that we have managed to double our forecasted capacity every year for the last five years also stands as proof that we can deliver on our claims.”

Veeken explained that Dexter Energy's products are designed to address asset-backed energy trading needs related to curtailment price cannibalization, negative spot and imbalance prices, along with solar “duck curve” demand patterns and their effect on prices.

“Our products help renewable energy producers navigate this new reality and minimize their balancing costs. Our Power Forecast helps our customers lower their imbalance volume, reducing the risk of open positions in the balancing market and the financial penalties associated with them,” he said.

Curtailment, the name of another Dexter Energy tool, provides signals to customers about when to deliberately reduce over-production when it is financially optimal, for example.

“These models learn from vast streams of weather data, market prices, and real-time SCADA data. All the heavy lifting happens in our secure cloud environment, so there is no proprietary hardware to install. Traders simply pull the signals through a REST API,” said Veeken, referring to a representational state transfer (REST) application programming interface (API) widely used to exchange information securely over the Internet.

Founded in 2017, Dexter Energy announced this month it will invest in further growth, expanding the business across Europe, further develop its existing products, and increase support for battery storage trading. It raised a €23 million ($ 27.04 million) Series C round of venture capital from a group of Dutch and international institutional investors to help reach its goals. The company claims over 80 energy companies as customers, including Sunrock and Pure Energie, both based in the Netherlands, UK-based Centrica Energy and Belgium-based Luminus Energy.

Image: Dexter Energy

What's Your Reaction?