EU expresses reluctance on opex support for solar, cleantech manufacturers

The European Commission has told pv magazine that it will unlikely prioritize operating expenditure (opex) support for solar and clean technology manufacturers, citing concerns about potential market distortion, even as insolvencies rise across the European PV sector.

The European Commission has told pv magazine that it will unlikely prioritize operating expenditure (opex) support for solar and clean technology manufacturers, citing concerns about potential market distortion, even as insolvencies rise across the European PV sector.

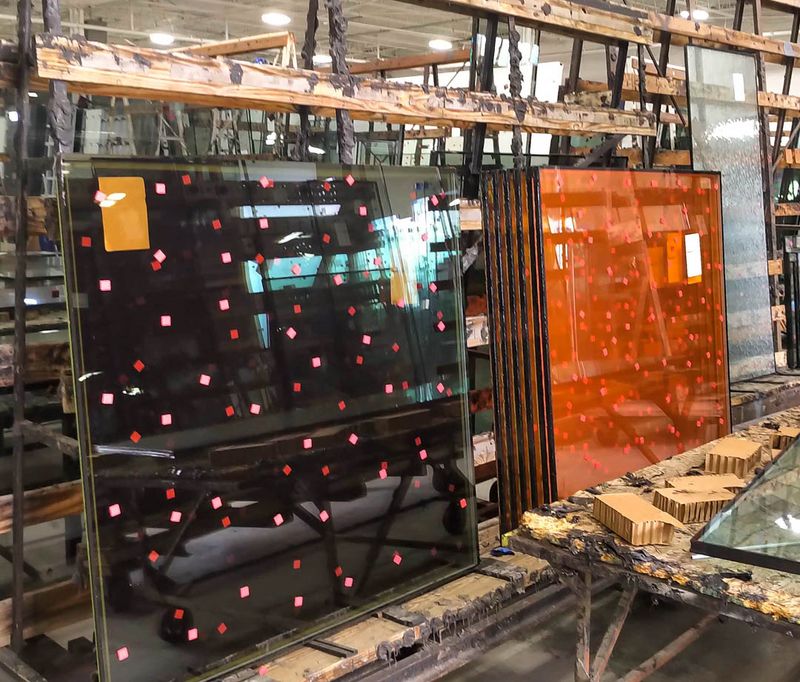

German glass maker GMB launched insolvency proceedings this week, joining a long list of European solar producers that have declared insolvency over the past two years despite capital expenditure (capex) support and other incentives from the European Commission and several EU member states.

Several industry analysts say the European PV sector needs operational expenditure (opex) support – measured in euros per watt produced – across the entire supply chain, similar to the US Inflation Reduction Act (IRA) under the administration of former US President Joe Biden. Funding new, highly automated factories for glass, polysilicon, wafers, solar cells, and modules may not ensure survival if ongoing operating and maintenance costs remain uncovered, especially amid current global overcapacity and highly volatile energy prices in Europe.

Despite these challenges and signs that current incentives may be insufficient to revive the continent’s PV industry, the European Commission has so far resisted implementing an opex scheme. The commission aims to balance reshoring efforts while maintaining relatively free market conditions.

“Aid covering opex is considered to particularly distort competition, as it contributes to the maintenance of inefficient market players, without creating any incentive for them to become more efficient,” Luuk De Klein, the press officer for the European Union's competition commission, told pv magazine. “This also applies where opex would be supported in the context of a new investment, as it creates the risk of crowding out existing producers from the market.”

De Klein noted that under normal market conditions, clean technology producers should be able to cover their operating costs without additional public support.

“The commission stands ready to assist member states to identify the appropriate ways to design, under the state aid rules, public support that addresses market failures, is necessary, proportionate and does not unduly distort competition and trade in the single market or to design such public support free of state aid,” added De Klein.

He also noted that aid could be granted on a case-by-case basis to cover the funding gap between EU support and subsidies offered by non-EU countries, if there is a concrete risk of investment being diverted away from Europe.

“The funding gap methodology covers all relevant costs, including capex and opex, as well as the expected revenues of such a project,” he said.

The extent to which the funding gap approach could cover opex support remains unclear. The European Solar Manufacturing Council (ESMC) considers opex incentives “essential” to bridge the cost gap between European-made modules and Chinese imports.

“Similar mechanisms are about to be used to support battery production in Europe,” said Christoph Podewils, an ESMC spokesperson. “The Innovation Fund and other EU instruments should be deployed urgently to support solar manufacturing with performance-based, transparent and time-limited opex schemes. Reform EU state aid rules (CISAF) should include operating cost support and streamline procedures. A simplified, flexible, and generous state aid framework is essential to save European solar manufacturing.”

The ESMC said that under normal market conditions, clean technology producers should be able to cover their operating costs without additional public support, especially when their investment costs have already been subsidized.

“Operating aid has the potential to be particularly distortive as it can directly reduce the cost of goods or services provided on the market and maintain in the market operators that are loss-making on a long-term basis,” said Podewils. “However, clean technology manufacturers like battery producers might face unfair global competition, unexpected cost overruns, or uncertainties on future demand, for example, but not only during the ramp-up period, which are inherent in their operations.”

European PV association SolarPower Europe said opex support will be crucial to revive the European renewable energy manufacturing industry.

“The main cost differential between EU-made and global competition is in opex, which means running solar factories,” a SolarPower Europe spokesperson told pv magazine. “This is our main hurdle to global competitiveness. If we are serious about rebuilding a resilient European solar manufacturing industry, we must support opex.”

SolarPower Europe added that the Clean Industrial Deal State Aid Framework (CISAF), approved on June 25, is another missed opportunity to support opex for solar manufacturers. The scheme does not include operating cost support for producing and selling final products.

“We need the next EU budget to reserve funding for supporting capex and opex for solar manufacturers,” the spokesperson said. “Clean energy infrastructure, including solar, is the backbone of EU competitiveness; budget commitments must reflect this priority in the face of global competition.”

What's Your Reaction?